Average Insurance Cost for Restaurants

Your Restaurant insurance cost can range anything from $300 to $10k per year depending on your insurance needs. Here's a guide on the average cost of restaurant insurance.

Embarking on the exciting journey of restaurant ownership brings with it a crucial question: How much does it cost to insure a restaurant? This article is tailored specifically for new restaurant owners, providing a clear, comprehensive breakdown of the average insurance costs you can expect.

Understanding these costs is vital for effective financial planning and risk management. By the end of this article, you'll have a detailed insight into the various insurance policies available and their costs, empowering you to make informed decisions to protect your culinary venture.

Cost of Restaurant Insurance by Policy

Navigating the world of restaurant insurance can be complex, with various policies catering to different risks. This section breaks down the costs associated with each type of policy, helping you understand and budget for your specific needs.

Business Owner’s Policy (BOP)

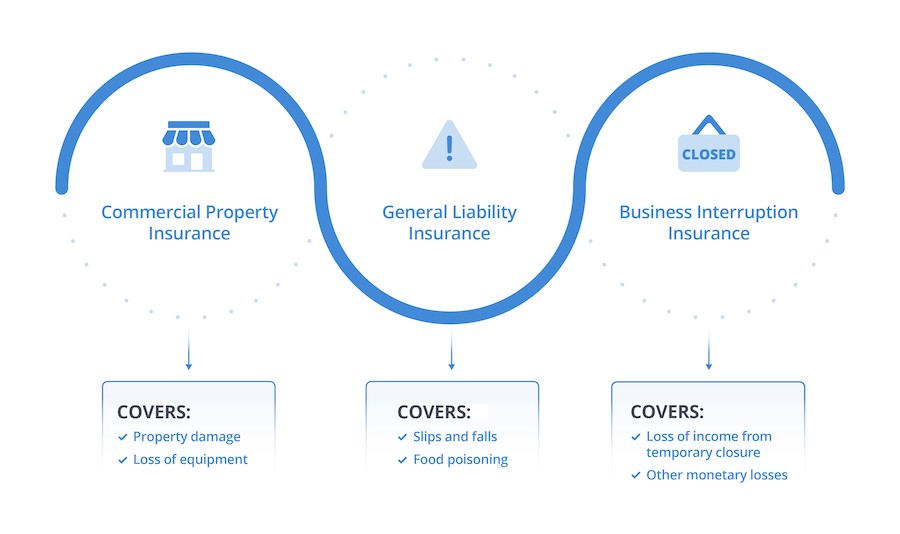

A Business Owner’s Policy (BOP) is a comprehensive insurance package crucial for restaurant owners, combining several key insurance products into one policy. This package typically includes Commercial Property, General Liability, and Business Interruption Insurance, each addressing critical aspects of risk management for a restaurant.

Average Costs for Business Owner’s Policy

| Cost Type | Amount (USD) |

|---|---|

| Average Monthly Cost | $180 |

| Average Annual Cost | $2,160 |

Note: The cost of a BOP can vary significantly based on factors such as the size and location of your restaurant, and the type of food served. While traditional BOPs combine General Liability and Commercial Property Insurance, it's highly beneficial for restaurants to opt for a package that also includes Business Interruption Insurance. This comprehensive coverage ensures better protection and can be more cost-effective. When comparing policies, be aware that some insurers might offer seemingly cheaper options by excluding Business Interruption Insurance.

Takeaway: For restaurant owners, a BOP that packages General Liability, Commercial Property, and Business Interruption Insurance together offers the most effective coverage and can be more economical in the long run.

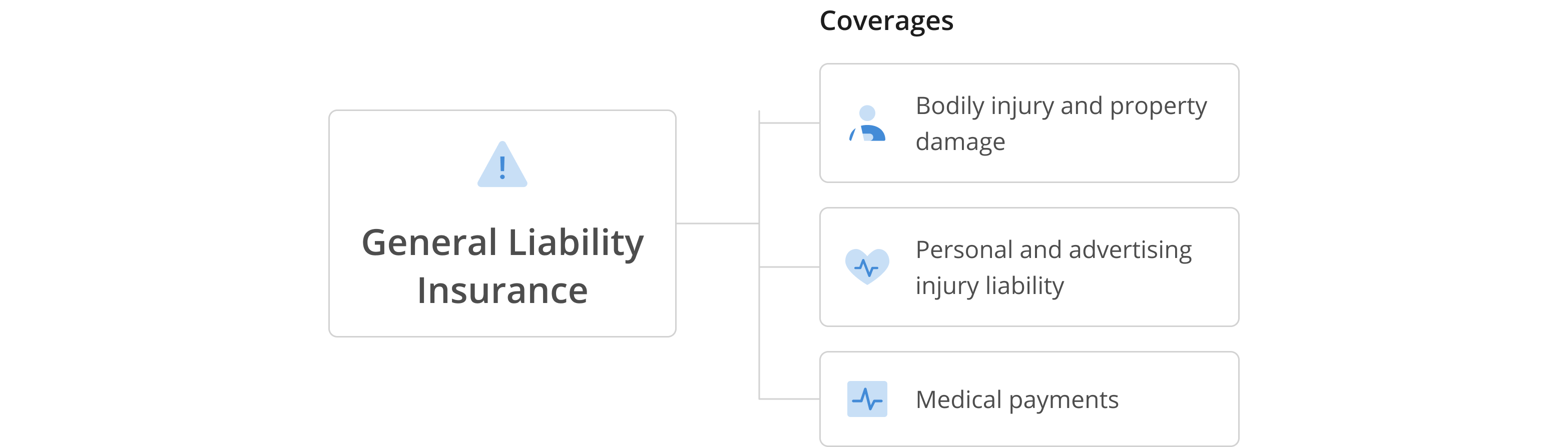

General Liability Insurance

General Liability Insurance is essential for restaurant owners, offering protection against a range of risks such as third-party bodily injury, property damage, product liability, and issues like libel and slander. This policy is a cornerstone in safeguarding your business from common incidents that can occur in the bustling environment of a restaurant.

Average Costs for General Liability Insurance

| Cost Type | Amount (USD) |

|---|---|

| Average Monthly Cost | $80 |

| Average Annual Cost | $900 |

Note: The annual cost of General Liability Insurance can vary significantly, ranging from $500 to $2,500. The specific cost for your restaurant will depend on the level of exposure to risks covered by this insurance, including third-party bodily injury, property damage, product liability, and reputational harms like libel and slander.

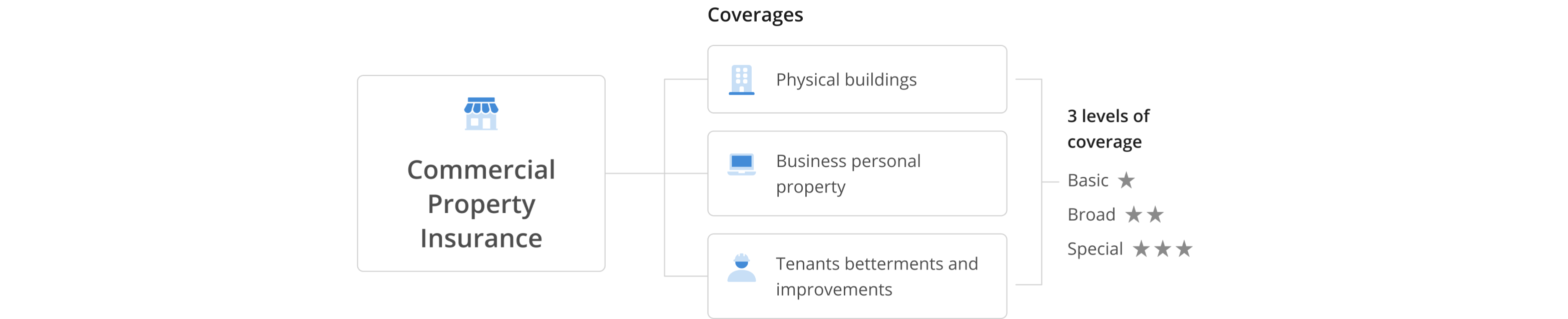

Commercial Property Insurance

Commercial Property Insurance is crucial for restaurant owners, providing coverage for physical assets against risks like fire, water damage, natural disasters, theft, vandalism, and equipment breakdown. This policy is vital in protecting the physical foundation of your restaurant, including the building, equipment, and other property essentials.

Average Costs for Commercial Property Insurance

| Cost Type | Amount (USD) |

|---|---|

| Average Monthly Cost | $80 |

| Average Annual Cost | $900 |

Note: The annual cost of Commercial Property Insurance can range from $500 to $2,500. The cost for your restaurant will depend on its exposure to various risks such as fire and water damage, storm and natural disaster damage, theft and vandalism, equipment breakdown, damage to signs and exterior fixtures, and glass breakage.

Business Interruption Insurance

Business Interruption Insurance plays a pivotal role in safeguarding restaurants against financial losses due to unforeseen closures, such as those caused by fires or other covered incidents. This insurance is typically part of a broader Business Owner's Policy, which also includes property and liability coverage.

Average Costs for Business Interruption Insurance

| Cost Type | Amount (USD) |

|---|---|

| Average Monthly Cost | $80 |

| Average Annual Cost | $900 |

Note: The cost of Business Interruption Insurance, as part of a Business Owner's Policy, can vary based on factors like the restaurant's location, type, coverage needs, and property value.

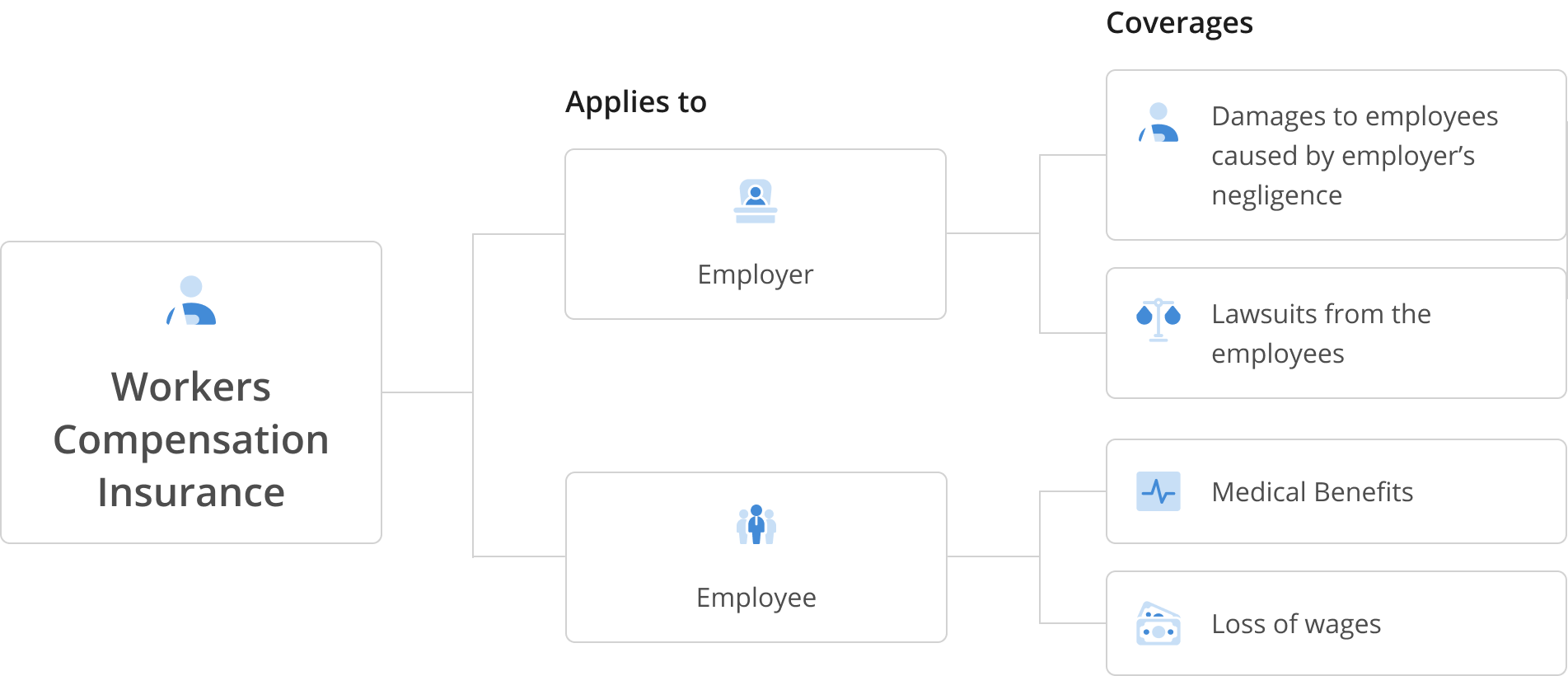

Workers' Compensation Insurance

Workers' Compensation Insurance is a fundamental policy for restaurant owners, designed to cover employees in case of work-related injuries or illnesses. This insurance is not only a legal requirement in many areas but also a critical component in protecting your staff and your business from the financial implications of workplace accidents.

Average Costs for Workers' Compensation Insurance

| Cost Type | Amount (USD) |

|---|---|

| Average Monthly Cost | $125 |

| Annual Cost Range | $600 - $10,000 |

Note: The annual cost of Workers' Compensation Insurance can vary significantly, ranging from $600 to $10,000. Factors influencing where your restaurant falls within this range include the payroll size (how much your employees earn), the risk level of the jobs performed, and your past claims history.

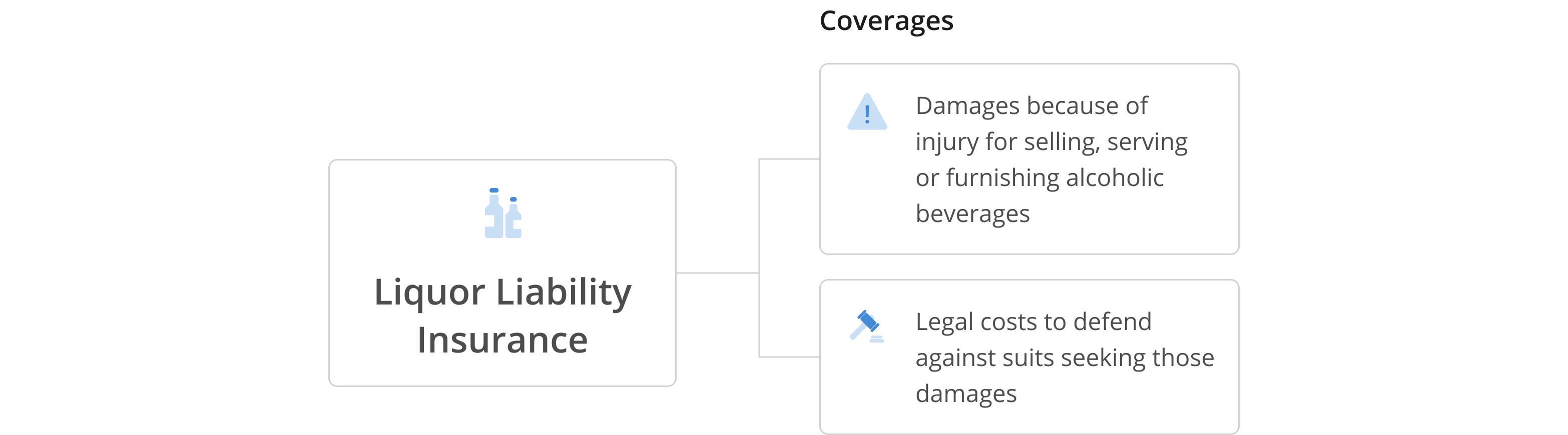

Liquor Liability Insurance

Liquor Liability Insurance is a must-have for any restaurant that serves alcohol. This policy covers claims made against your establishment if you serve alcohol to someone who is already intoxicated, and they subsequently cause damage or assault, either inside or outside your restaurant.

Average Costs for Liquor Liability Insurance

| Cost Type | Amount (USD) |

|---|---|

| Average Monthly Cost | $45 |

| Median Annual Cost | $545 |

Note: The annual cost of Liquor Liability Insurance can vary widely, ranging from $300 to $3,000. Factors influencing the premium include: Sales volume of alcohol from your restaurant, location (high risk v low risk neighbourhood), type of alcohol served (only beer vs all alcoholic beverages), safety measures (trained bartenders) and your claim history.

Tips To Save Money On Your Restaurant Insurance Cost

Reducing insurance costs is a key concern for restaurant owners. Implementing certain strategies can help lower premiums while maintaining essential coverage. Here's a table outlining practical tips for different types of policies:

| Policy | Tips to Lower Premiums |

|---|---|

| General Liability + Commercial Property + Business Interruption |

|

| Workers' Compensation Insurance |

|

| Liquor Liability Insurance |

|

Takeaways

TAKEAWAY 1: It's important to remember that the figures provided in this article are not precise estimates but rather averages drawn from a variety of sources, including many leading U.S. insurance providers for restaurant owners. These numbers serve as a general guide to help you understand what you might expect in terms of insurance costs.

TAKEAWAY 2: The actual cost of your premiums for any given policy will depend on a multitude of factors. While we've highlighted some key considerations, there are additional variables that could influence the cost of insuring your restaurant. Every restaurant establishment is unique, and factors such as location, size, type of service, and specific risk exposures play a significant role in determining insurance costs.

TAKEAWAY 3: For the most accurate estimate tailored to your specific restaurant, it's essential to get a personalized quote. This will take into account all the unique aspects of your business and provide a clearer picture of your insurance expenses. Click the button below to start the process of obtaining a quote that reflects your restaurant's individual needs and circumstances.

3 Easy Steps to Get Your Restaurant Insured Today

Talk to an expert in restaurant insurance

Speak with an experienced agent for expert advice to get your restaurant insured quickly.

Flexible payment options

Choose from multiple payment plans to insure your restaurant business today.

Download your insurance certificate

Get your Certificate of Insurance (CoI) within a day, and show everyone you're insured.