What is Cyber Liability Insurance?

Small businesses can face hefty fines and expensive legal settlements if clients' or employees' personal data are leaked or stolen.

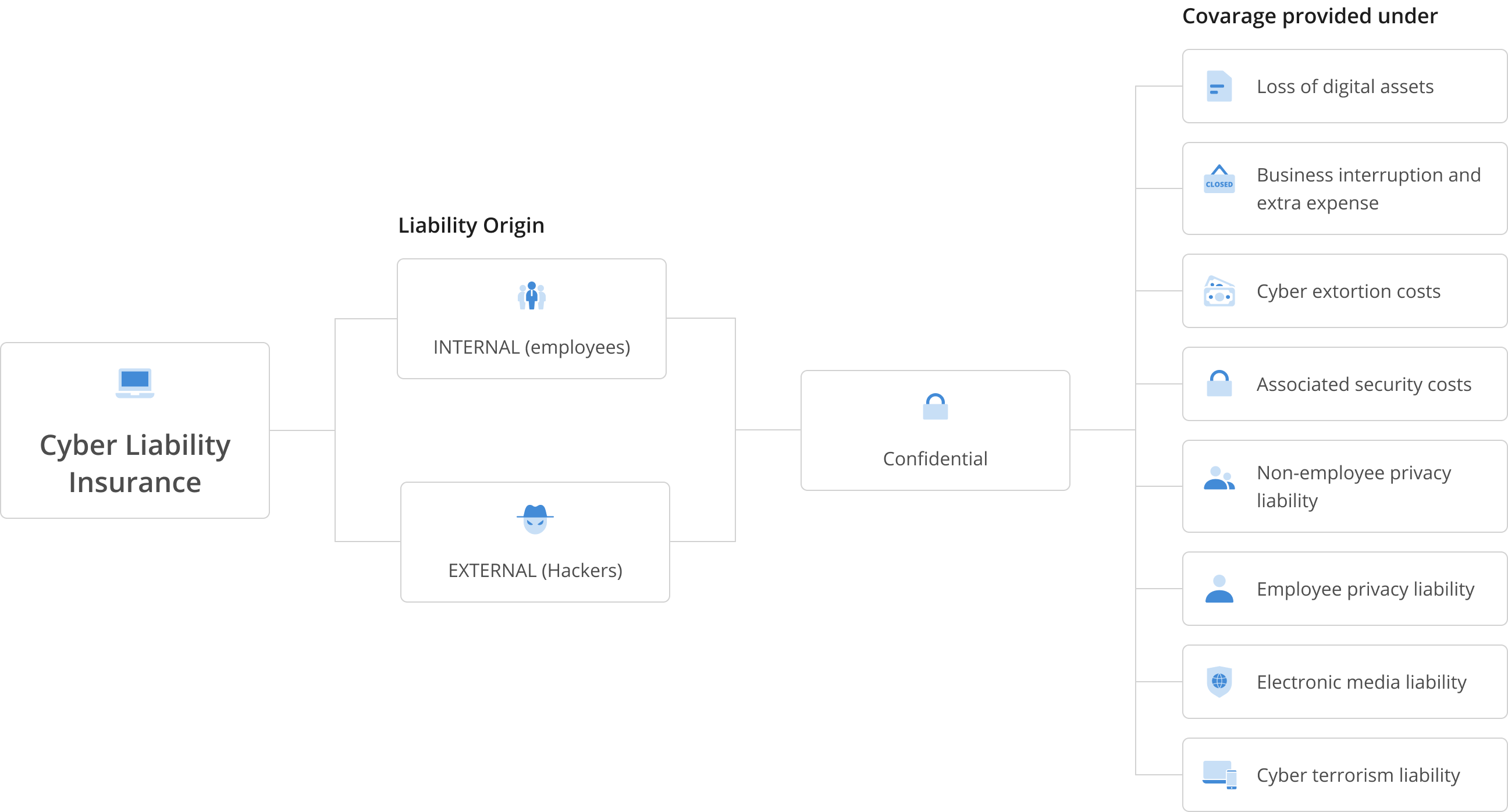

Cyber Liability Insurance protects businesses from the increasingly sophisticated and complex threats in our tech-driven society.

Best in class insurance partners

What Cyber Liability Insurance Is All About:

What Does Cyber Liability Insurance Cover?

Frequently Asked Questions

What are potential Cyber Liability Insurance Requirements?

While there are currently no specific requirements for Cyber Liability insurance, most insurance companies will expect you to report any loss in a reasonable period of time. It is also a good idea to prevent any further loss once you know something has happened.

What is the difference between Cyber Insurance and Data Breach Insurance?

Data Breach, also referred to as Data Compromise, is a part of Cyber Liability insurance. Data Breach is when electronic data is leaked usually by theft, whether a hacker or a stolen computer.

There is usually a sublimit for Data Breach which means once that limit is reached, no more benefits will be paid. Cyber Liability is more geared towards notifying the parties that have been affected by the cyber event.

Does Cyber Insurance cover phishing?

While phishing is not directly stated as a coverage amount on a Cyber Liability insurance policy, you can find coverage for it under Social Engineering because it is considered deception, impersonation, or fraudulent instruction.

This coverage also usually has a sublimit, so be sure to pay attention to all of the limits on the policy.

Does Cyber insurance cover ransomware?

Yes, and often the insurance company will pay the ransom rather than attempt to fight the person or people who have taken your data, as there is a higher chance of having your data returned unharmed. Check with an advisor.