What is Business Owners Policy (BOP)?

Business Owners Policy simplifies coverage needs by combining two policies that most businesses need - business liability and business property:

-

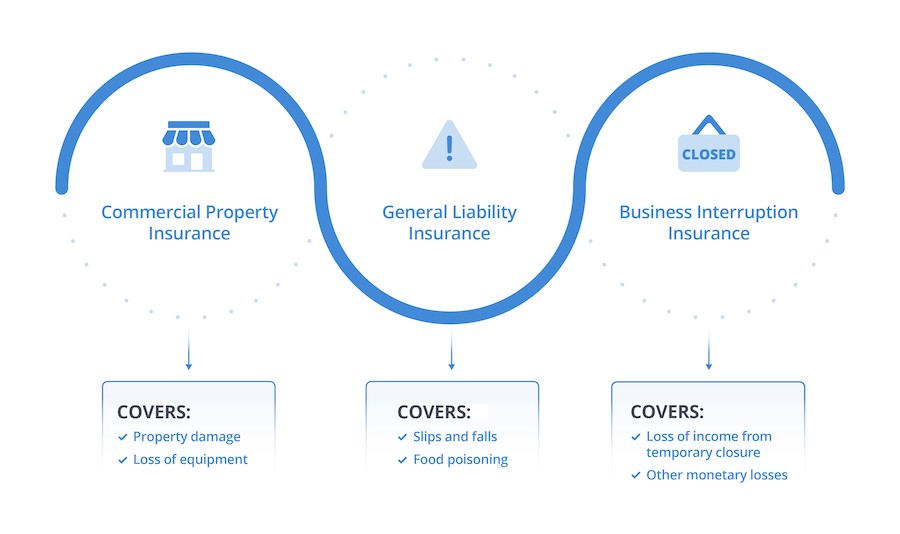

Business Liability: The coverage for business liability under BOP is the same as General Liability Insurance. This covers claims including consumer injury, advertising harm, and product liability.

-

Business Property: This covers the structure of your commercial property as well as your business’ property, including mobile items used for business purposes. Business property under BOP can also pay for things like debris removal, lost income, and environmental cleaning.

-

Business Interruption: If a disaster compels you to shut down temporarily, your business could face a financial setback. Business Interruption Insurance steps in to help replace lost income in the event of a covered loss.

Best in class insurance partners

What a Business Owners Policy Is All About:

How Much Does a Business Owners Policy Cost?

Purchasing a policy bundle is typically more affordable than purchasing General Liability and Property Insurance separately. Most providers will offer a discount of 15 to 20 percent.

The premium for a BOP will be determined based on a number of factors, including your business’s location, risk factors, number of employees and size. Premiums can range anywhere from $500 to $15,000.

What Does a Business Owners Policy Cover?

Frequently Asked Questions

What types of businesses are not eligible for a BOP?

A business owners insurance policy is designed for small businesses. It is a one-stop-shop kind of policy and for certain medium and large businesses this may not be good because you cannot tailor the coverage to your needs. If you are a manufacturer you should read your coverage carefully and more often than not, get a General Liability policy.

Is a Business Owner’s Policy required by law?

The type of business you own and operate will dictate whether or not certain insurance policies are required by law. While a BOP is not required by law, sometimes General Liability is. Since the BOP is comprised of General Liability and Property it may be the best option for you as far as coverage and price go. Additionally, some professional services like therapists and consultants can be required to purchase Errors and Omissions insurance.

Does a BOP cover independent contractors?

As always, it is important to not only read your policy but to check with an experienced advisor to make sure you have the best policy for your needs. Most BOP’s will be able to provide coverage for independent contractors but that does not mean all of them will. All insurance policies are not created equal.

Can I combine other entities on my policy as part of my Named Insured?

You can combine different entities as a named insured on your policy if certain requirements are met. This usually includes having similar ownership and similar operations. It is important you check with an advisor as it almost always requires underwriter approval from the insurance company.

How do I make a General Liability or Property Insurance claim on my BOP?

If you have the unfortunate need to report a claim you can simply consult with a CoverWalllet advisor to get the process started. We will walk you through the process and save you from all the hassle.

Am I eligible to get a Business Owners Policy?

Not every business is eligible for a BOP. Eligibility requirements vary among insurance providers. Here’s a general overview of what is considered when determining eligibility:

- Certain class of business (eligible classes includes small restaurants, stores, office- or service-based businesses, wholesale distributors, apartments and independent contractors).

- Where you conduct the majority of business operations (most policies require your business to complete most of its business on the premises).

- The size of your business’s primary location.

- Your revenue.

Who Is Covered by Business Owners Policy Insurance?

Business and Employees Your business and all employees will be covered for claims that arise claiming bodily injury or property damage to a third party caused by the business. Additionally, your business property will be covered, so you can replace it should a covered event happen.

Parties to a Contract If you enter into a contract for work and a party asks to be listed as additional insured on your policy you can do that here, that way if a claim arises out of your work, they will come to your policy first.

Suppliers If you sell products or rent a piece of equipment, it is likely that the supplier will ask for you to indemnify them if a claim results with that product or the equipment is damaged.

What is not covered under a Business Owners Policy?

- Employees: If you have employees you need to buy separate policies like Workers Compensation, Health and Disability insurances, which are not covered under a BOP.

- Vehicles for Work: If you use a vehicle for work you need to purchase a seperate Commercial Auto insurance policy.

- Professional Services: If you offer professional services to clients you will need to purchase a seperate Professional Liability policy (frequently available as an optional addition to a BOP).

- Intentional bodily injury: Intentional bodily injury or property damage when you or your business is at fault.

- Liquor liability: It applies if your business manufactures, sells, distributes or serves alcoholic beverages.

- Bodily injury: Bodily injury to an employee that results from employment (this would be covered under Workers Compensation Insurance).

- Medical expenses: To any person if they are otherwise eligible for coverage under a Workers Compensation Insurance policy, a disability benefits law, or something similar.

What are the "limits" of a Business Owners Policy?

The limits of a BOP will vary according to the General Liability and Property Insurance policies in your bundle. Business Interruption Insurance typically provides up to 12 months-worth of income for businesses when they are forced to suspend operations due to a covered event. Additionally, you should always read the wording of your policy carefully.

Standard policies only provide compensation for damages caused by events specifically listed, such as a fire, smoke damage or vandalism. Your policy may also list certain items as “property not covered” under Property Insurance. However, if you’d like more protection, you can purchase a “special” policy that offers open-peril coverage.

What is the difference between general liability and business owners policy?

General Liability insurance is there to provide protection against those third parties should they get hurt and develop a bodily injury. It also covers third party property damage and advertising liability, such as slander or libel. With the internet and social media, these things have a way of happening even if you don't mean for it to occur.

Business Owner's policy or BOP includes General Liability insurance, but also includes some property coverages such as building and business personal property. A BOP is an affordable and easy way to cover your small business for these critical risks. In addition, you can add coverage for business interruption, so that if a covered claim does occur, you can keep your business running while it is repaired. Read more about the difference between BOP and GL.

What is an unendorsed business owners policy?

Property coverage is provided on an open peril (special form) basis in the unendorsed BOP. An endorsement can be added to offer coverage for a specific danger.