What is Commercial Auto Insurance?

From accidents to injuries, having a commercial vehicle for your business comes with many risks. However, for many businesses having a company vehicle is crucial, which means having the right protections in place are just as crucial as having the vehicle itself.

Let us introduce you to Commercial Auto Insurance. The insurance that protects your business from vehicle-related accidents, so you can sit back and enjoy the ride.

Best in class insurance partners

What is Commercial Auto Insurance All About?

What Is Commercial Auto Insurance Coverage?

Business Automobile Liability Insurance is for businesses that own and operate vehicles. This insurance helps companies cover the costs of repairing or replacing company vehicles within the boundaries of the insurance policy.

Every business that uses vehicles to transact business needs Commercial Auto Insurance. Companies using their personal vehicles for business-related purposes may find that their personal insurance does not cover business-related risks. Personal Auto Insurance on a vehicle used for business purposes may not have enough insurance, leaving the company financially responsible for losses.

Business Automobile Liability Insurance was purposefully designed to help protect businesses from the unknown. With higher coverage limits than personal auto insurance, it helps safeguard businesses and improves a business’ chances of continual operations.

Commercial insurance contracts create partnerships between companies and insurers. Under these contracts, insurers are required to pay for physical damages based on the terms of the insurance policy and up to the limits of the insurance coverage. Insurers can’t cancel Commercial Auto Insurance if a business files a claim against the insurance policy.

Businesses can purchase Commercial Auto Liability coverage for their cars, trucks, heavy-duty trucks, and semi-trucks.

Depending on the coverage selected, this insurance covers vehicles the business owns, contracts with, and leases. It also helps cover injured employees should an accident happen.

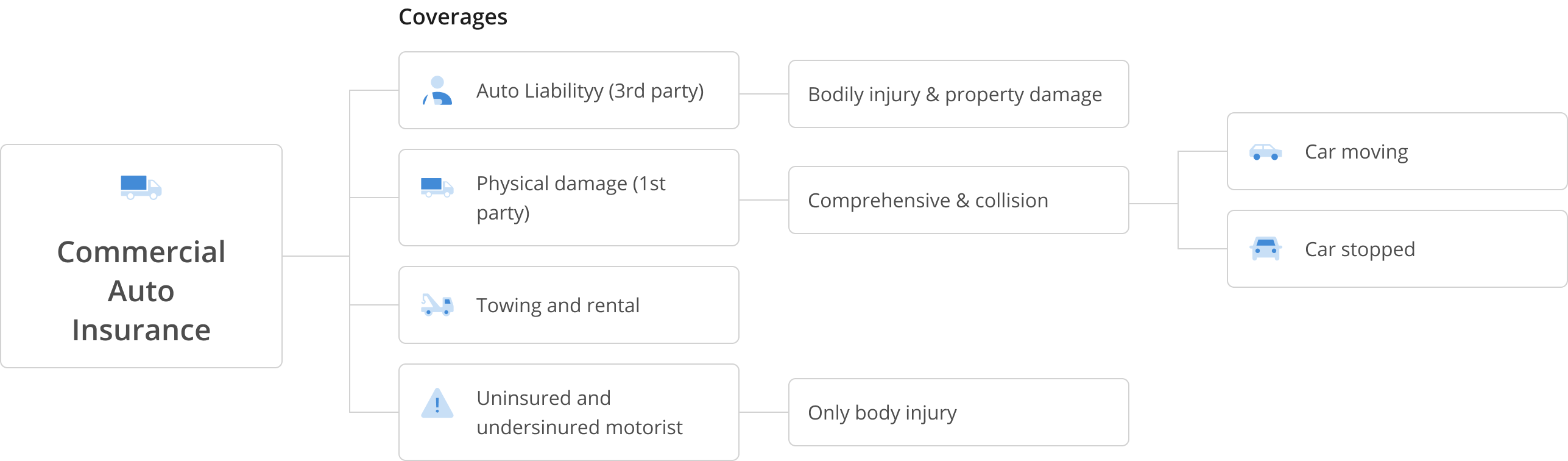

What Does Commercial Auto Insurance Cover?

Frequently Asked Questions

What vehicles are covered under commercial auto insurance?

Vehicles that you are using for your business should be covered under Commercial Auto insurance. Some policies will be set up to only cover your owned vehicles, while other more comprehensive policies will cover any auto you are using throughout the course of your work. If you're confused, consult with a CoverWallet advisor.

In the event of a claim, how is the value of my vehicle determined?

Getting in a car accident is a terrible, but almost unavoidable, situation. Luckily, you have Commercial Auto insurance to be by your side. Understanding how it works will help to get you through the process easily. While insurance companies vary when it comes to coverages and premiums, the way a vehicle value is determined is the same across the board.

When it is time for an auto claim, you may have many questions. One common question is how the value of your vehicle will be determined. You want to make sure that if you have to deal with this stressful situation you understand how your vehicle value will be determined so there are no surprises. When you first report your claim you will get assigned an adjuster and they will be responsible for walking you through the claims process and determining the value of the vehicle.

Several factors will determine the value of your car in the event of a claim. The claims adjuster will determine the cash value of your car, which is replacement cost minus depreciation. Keep in mind that you also will be responsible for your portion of the deductible so it is important that you understand your coverage amounts. To avoid a gap in coverage here, it is recommended that you purchase new vehicle replacement coverage. Don’t always go for cheap Commercial Auto insurance. They will also look at the blue book value of your vehicle.

Can I insure my motorcycle with this insurance if I use it for my business?

A motorcycle is not designed to be covered under a Commercial Auto insurance policy. You will need to purchase a separate Motorcycle insurance policy. The cost will depend on your type of business, how many motorcycles you wish to insure, and the U.S. state that you are in.

Who can drive the car that’s insured?

For standard vehicles it is often anyone with whom you give permission to drive the vehicle, as long as they are licensed and not currently excluded on your policy.

What's the difference between Commercial & Personal Auto Insurance?

Personal Auto insurance is designed for vehicles that you are using for personal reasons. Once you start using your vehicle for business purposes, coverage can be excluded. Commercial Auto insurance will provide coverage for both business and personal use.

Are the items that I transport with my insured vehicle covered by this policy? (ex: equipment, valuables...)

Your items that belong to the business that are transported in the vehicle will be covered under your Commercial Property policy, or Inland Marine if you have your equipment insured on that type of policy.

I use my personal vehicle for my business. Can I insure it with this policy?

Yes, but it is recommended that you title the personal vehicle in the business name to avoid any gaps in coverage. The problem comes in when you own a business that is anything other than a sole proprietor.

If you or your employee is involved in an accident and is sued, the business will be sued. However, you could also be sued individually if you are the driver.

If the named insured on the policy is the business, but the vehicle is titled in your individual name, this could leave you with a huge gap in coverage.

The good news is that a personal vehicle can be titled in your name and be insured on a Commercial Auto policy even though the opposite is not an option. If you use your personal vehicle for work, it can not be covered under a Personal Auto policy.

Do you need commercial auto insurance in Florida?

Living in the sunny and warm state of Florida certainly has its perks. Longer days of light means you can work longer and make more money. With many people moving to Florida to get away from bad weather, that means the population may be denser.

This also means that there are more cars on the road, therefore more chances you or your employees can be involved in an auto accident.

If you have any vehicles that are owned by your business, any personally owned vehicles used for the business, or employees use their vehicles, you should have a Commercial Auto insurance policy.

When it comes to Business Auto policy coverages, there are some standard ones and then some you can add. Standard coverages include liability and property damage which will cover your business liability if you are in an accident, and the cost to repair or replace the vehicle, as well as a third party’s vehicle if you are at fault.

Medical expenses are also a standard coverage for your passengers. Additional coverages you can add include first-party benefits such as a funeral, accidental death, and work loss.

Also, if your employees use their vehicles for work purposes you should add Hired and Non-owned Auto Liability so if they are at fault in an accident while on the clock, your business liability will be covered.